In June 2018, the Supreme Court of the United States issued a ruling that could have a significant impact on businesses in every state. In South Dakota v. Wayfair Inc., the court ruled that states can require out-of-state sellers to collect and remit sales tax based on the establishment of an economic nexus instead of just a physical presence in the state. The ruling has set off a flurry of activity among other states as they figure out how to react to their expanded sales tax authority.

The Wayfair Decision

The Wayfair decision overturned a 1992 decision, Quill Corp. v. North Dakota, when the court ruled that out-of-state sellers had to collect sales tax only if they maintained a physical presence in the state, such as an office or a warehouse. Quill Corporation was a mail-order company that sold office supplies and equipment to North Dakota buyers and because they did not have a physical presence in North Dakota, they did not collect sales tax from their North Dakota customers.

Since then, we’ve seen the ecommerce industry explode. According to Bloomberg, the U.S. Government Accountability Office estimates that state and local governments could have collected up to $13 billion more in 2017 had they been allowed to require sales tax payments from online sellers. The Quill decision basically allowed tax-free ecommerce on the Internet in the United States, so no state tax was collected on all those sales.

In 2016, South Dakota passed a law that would allow it to collect sales taxes on out-of-state online retailers. Aiming directly at the Quill decision, the state government then filed suit to have the case heard by the higher courts.

Which brings us to the Wayfair decision, in which the court ruled in favor of South Dakota and gave the state the authority to impose sales tax obligations on out-of-state transactions.

What is Nexus?

At the center of the Wayfair decision is the concept of nexus.

Think of nexus as a link between your business and a state. In tax law, nexus is the connection to a state that gives that state the authority to regulate individuals and businesses. States can specify the type of activities within their borders that create nexus and require taxpayers to comply with regulations. Businesses with activities in multiple states need to be aware of the obligations they face in those states. At issue in the Wayfair decision was a type of nexus called “economic nexus,” which means that a business has nexus with the taxing state only if it has sales in that state.

When the Supreme Court ruled in favor of South Dakota earlier this year, it found that Wayfair had enough economic and virtual connections to South Dakota to be sufficient grounds for economic nexus.

How the Wayfair Decision Will Affect Business

So, what happens now? How will businesses with Internet sales be affected?

As a result of the Wayfair decision, state taxing authority was expanded, and this will likely have widespread repercussions for businesses. Although South Dakota was the first state to be granted this authority from the court, several other states with economic nexus rules are expected to follow.

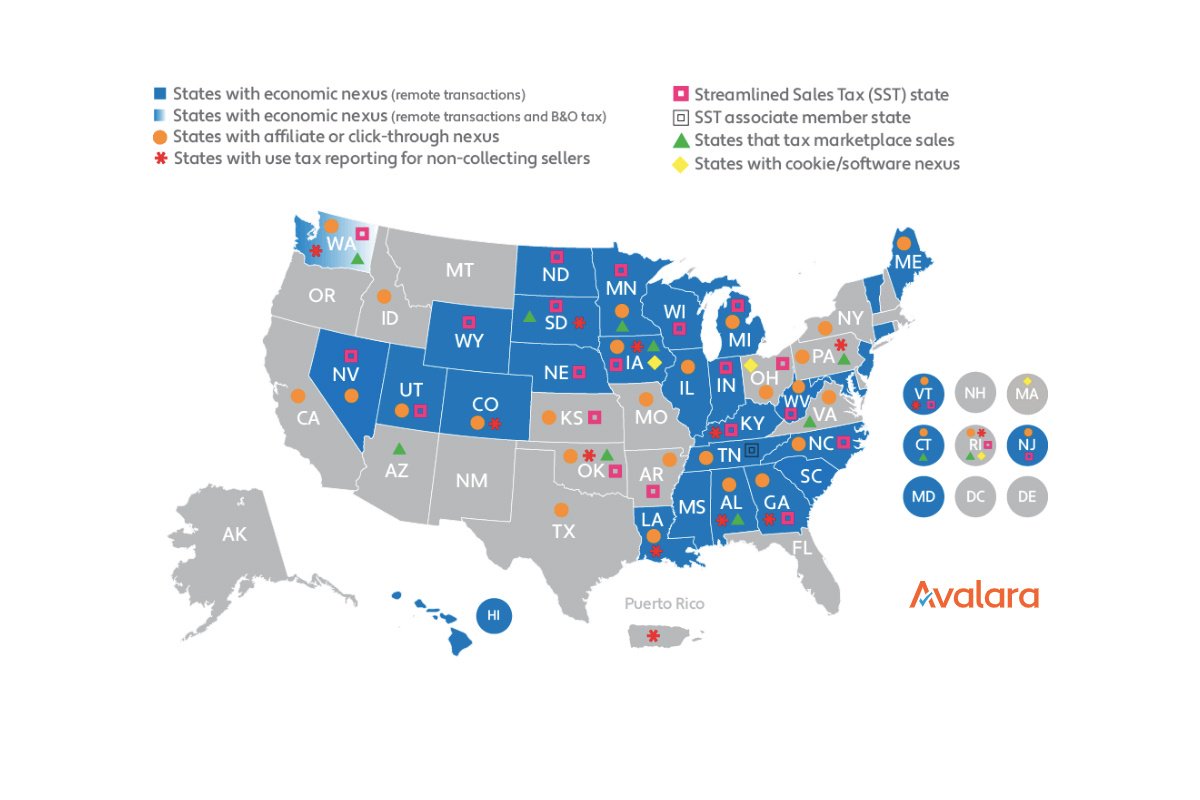

As of this writing, 29 states have and will be enforcing their new tax authority on Internet sales by January 2019. Businesses that sell in those states will be required to collect and remit sales tax from their customers.

However, the situation is far from resolved nationally because each state has its own start date and sales requirements that trigger economic nexus. Some states may act quickly to pass laws similar or identical to those passed in South Dakota. Others may pass laws with different requirements and will have to make significant changes to their sales tax system. Some states may pass laws that open them up to more litigation. Some states may not do anything until their next regular legislative session, and some states may never do anything.

Congress has a couple of pending bills (Remote Transactions Parity Act, or RTPA, and Marketplace Fairness Act, or MFA) that would tell states what changes they must make to be able to require online sellers to collect taxes. Such laws would be compatible with the Wayfair ruling, providing more protections for sellers and consumers. But opposition to these bills claim that they would tax the Internet, so it’s unclear if Congress will act at all.

Limits of the Wayfair Decision

In their ruling, the Supreme Court did not provide specific requirements that a state law must meet in order to be constitutional. However, they did examine South Dakota’s law and pointed to several provisions that helped keep it from becoming too burdensome:

- The state maintains a “safe harbor” for businesses with only a small number of transactions or low dollar-volume sales in the state;

- The state does not apply the law retroactively;

- The state adopted a “Streamlined Sales and Use Tax Agreement” that standardizes taxes and reduces administrative and compliance costs;

- The state provides access to sales tax administration software paid for by the state.

Any state that tries to collect sales taxes on internet sales without these provisions will likely face legal challenges. Those challenging such laws able will point to the rationale in the Wayfair ruling as guidance of what’s allowed.

What Should You Do Now?

If you sell in multiple states, you should track changing nexus laws in those states and be prepared to understand the impact of these changes on compliance and how they apply to your customers’ businesses.

You should also review your sales in every state in which you do business to understand the taxability in those states and update your list of exempt customers. To the extent that your business meets economic nexus thresholds and the transactions are taxable, if you operate in more than a handful of states, you should consider automating the calculation and collection of sales taxes.

If you do business in South Dakota, review your sales transactions carefully to see if you are required to collect and remit sales taxes in that state. You have economic nexus in the state if you are a remote seller and:

- Sold $100,000 in tangible personal property, electronically transferred products, or services delivered into the state;

- Made 200 separate transactions of tangible personal property, electronically transferred products, or services delivered into South Dakota in the current or previous calendar year.

Compliance and Enforcement

Even though the Wayfair decision places requirements on the state of South Dakota that will take weeks to complete, it is expected that states with similar economic nexus laws will begin enforcement by January 2019. Businesses with sales in those states will have to plan to comply with the new laws by then.

The states may also impose penalties and interest on unpaid sales tax obligations. Depending on how long a business has operated without collecting the taxes, some of those penalties can be significant.

Conclusion

It’s clear that sales tax obligations on out-of-state transactions across the United States are about to change. After the Supreme Court’s decision in South Dakota v. Wayfair Inc., several other states quickly moved to pass their own economic nexus laws. Businesses that sell remotely over the Internet will now be responsible for collecting and remitting state sales taxes from their customers.

But questions remain. Will other states pass their own remote seller legislation? Will Congress step in and pass federal legislation? As different levels of government determine what the decision looks like in practice, there is still a lot of uncertainty among remote sellers and their accountants on how to react.

For now, the best thing businesses can do is look at the impact of the decision in the states in which they do business, address seller reactions, and prepare to react in states that plan to enforce the new law.

To find out more, including the current status of the law in all U.S. states, check out Avalara’s South Dakota v Wayfair decision website. There you can find:

- Videos to “Hear what the experts are saying” featuring Avalara’s Vice President of U.S. Tax Policy and Government Relations, Scott Peterson, and tax expert and partner at Peterson Sullivan LLP, Rachel A. Le Mieux, CPA, CM;

- Avalara blog posts;

- Frequently Asked Questions;

- Downloadable Guide on the ruling.